how much are property taxes in california

The national average sits at 108. Now if the house is assessed at 5 million that would incur a significantly higher tax bill he explained.

Understanding California S Property Taxes

When the kids could inherit their parents house at the assessed value of 150000 the property taxes would be approximately 1500.

. Depending on where you choose to buy a home property taxes can range from negligible amounts to nearly matching a mortgage payment. The average effective after exemptions property tax rate in California is 079 compared with a national average of 119. California State Tax Quick Facts. AB8 Tax Increment by Taxing Entity within TRA Pre- ERAF.

Property taxes in California will never be below 1. California Department of Tax and Fee Administration. The total property tax as a percentage of state-local revenue is 1693 while the property tax percentage of personal income stands at 312. The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues.

073 average effective rate. 60 rows What are the California Property Tax Rates. California state tax rates are 1 2 4 6 8 93 103 113 123. Tax amount varies by county.

The California State Constitution currently caps ad valorem property tax rates for both commercial and residential properties at 1 of the full cash value at the time of acquisition with increases to assessed values capped at no more than 2 per year regardless of the propertys actual fair market value. 5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel. The California Property Tax Calculator provides a free online calculation of ones property tax. This incorporates the base rate of 1 and additional local taxes which are usually about 025.

Online Property Taxes Information At Your Fingertips. The median property tax in California is 283900 per year for a home worth the median value of 38420000. Lets talk in numbers. California real property taxes are based.

Finally the per-capita property tax in the US is 1618Scroll down to find all about these vital property taxes by state segments. Across California the effective annual property tax rate stands. It is designed to give readers a general understanding of Californias property tax system. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year.

Lets say for example you had a California personal income tax liability of 7000 last year and you expect a similar liability in 2018 and you paid 8000 of property taxes on your home. Any bonds that were voted on and approved are added as well as special assessments. Ad Property Taxes Info. California real property owners can claim a 7000 exemption on their primary residence.

The state property tax contributes 3008 towards the overall income. Heres who must pay California state tax. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. This reduces the assessed value by 7000 saving you up to 70 per year.

Generally your tax amount is 1 of the net value of your property but thats not all. Similarly How much is property tax in Orange CA. The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code. Of course the average tax rate in California varies by county.

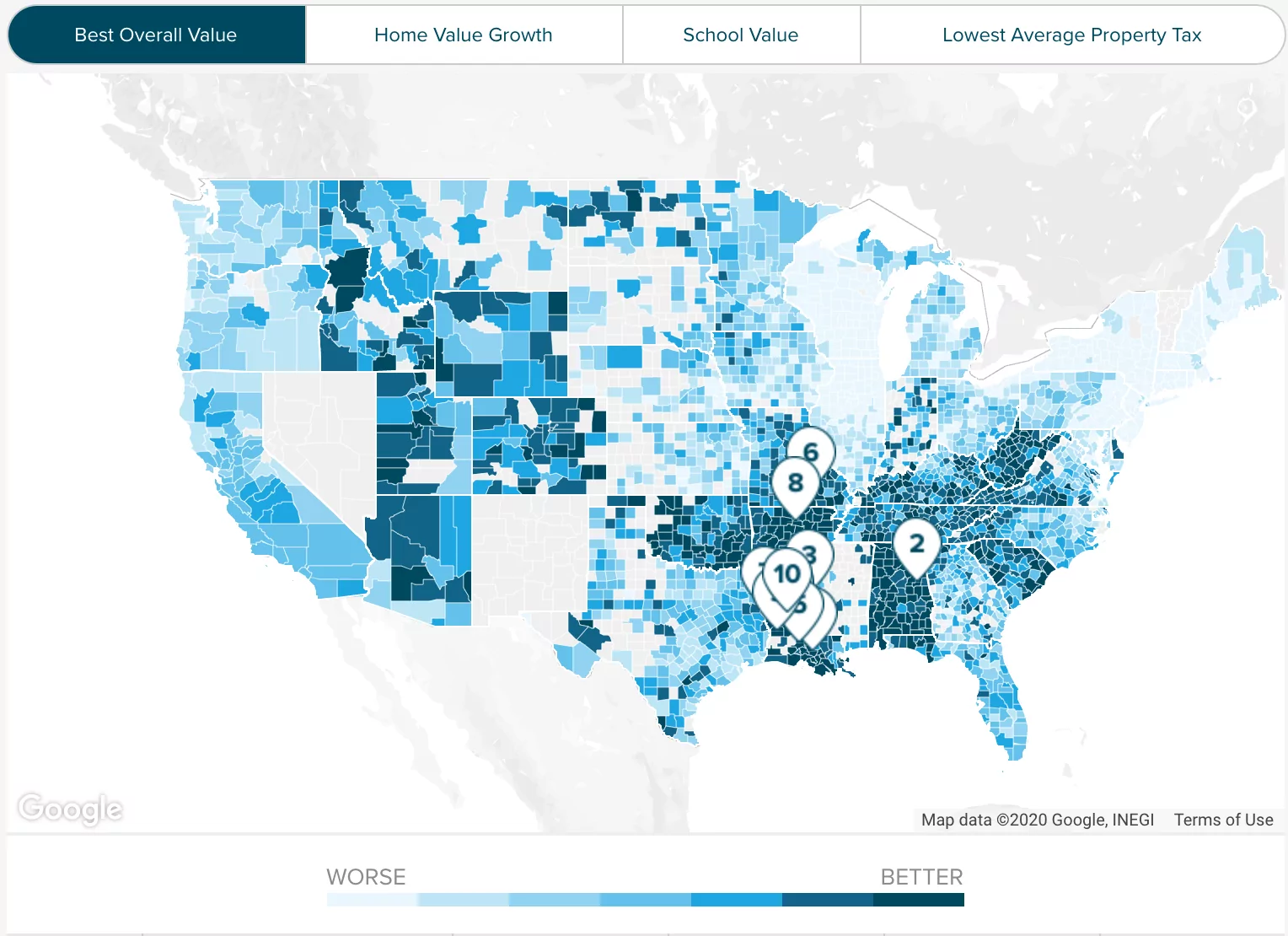

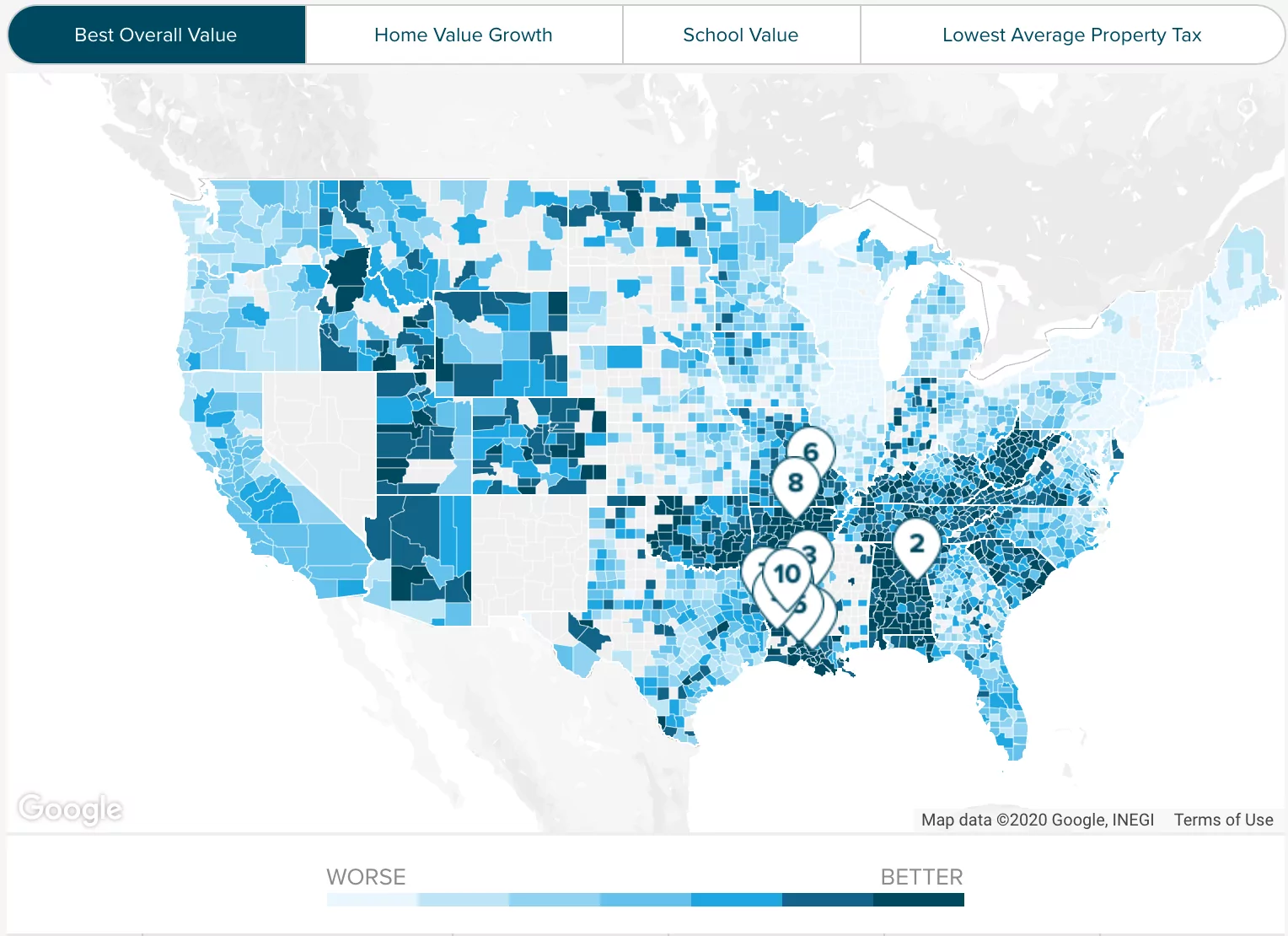

California Property Tax provides an overview of property tax assessment in California. Property taxes and charges are imposed on many types of property. How much property tax can you deduct in California. Californias overall property taxes are below the national average.

Overview of Orange County CA Taxes The average effective property tax rate in Orange County is 069 while the median annual property tax bill is 4499. Theres a 2 cap on this. If a property has an assessed home value of 300000 the annual property tax for it would be 3440 based on the national average. California Property Tax History.

1 Property Tax Rate Allocation to Taxing Entities AB8 This schedule shows the 1 property tax allocation as well as the adjustments for ERAF and redevelopment by taxing entity. If you pay less than 10000 of California tax your property tax deduction will be the difference between 10000 and your state income tax liability. An extra 1 may apply. You should claim the exemption after you buy a real property as you do not have to reapply each year.

The publication begins with a brief history of Proposition 13 which since 1978 has been the foundation of Californias property tax system. The average effective property tax rate in California is 077. In general you can expect to pay between 1 and 15 after everything is said and done although rates can be higher in some specific areas. For the 1 percent rate owneroccupied residential properties represent about 39 percent of the states assessed value followed by investment and vacation residential properties 34 percent and commercial properties 28 percent.

There are general numbers located on this page or you can check out online property tax calculators to get a general idea of what your taxes would be in a certain neighborhood. As of June 18 2021 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with California Government Code Sections. The median property tax on a 38420000 house is 284308 in California. Most countie provide websites where the general public can.

Understanding California S Property Taxes

Understanding California S Property Taxes

Alameda County Ca Property Tax Calculator Smartasset

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Posting Komentar untuk "how much are property taxes in california"